Financial Health & Behavioral Change

Key Findings from FinFit’s Financial Health Assessment

Introduction

FinFit’s mission is to eliminate stress in the workplace and improve the financial health of employees by providing solutions that empower them to address their financial situation and guide them down the path to financial stability. FinFit’s financial wellness platform provides personalized recommendations and solutions based on each employee’s unique financial needs. FinFit conducts regular financial assessments of its member base and through a series of questions, the company is able to understand how its members are spending, saving, borrowing and planning. Periodically, the member assessment data is compiled into a collective report. This research paper highlights some of the key learnings from FinFit’s most recent assessment results, providing unique insights into the financial health of 30,000+ members.

Core to FinFit’s philosophy is the belief that you need to accurately diagnose the financial health of individuals before you can improve their circumstances through behavioral change. It is why every FinFit member begins their journey with a financial health assessment. But what does ‘financial health’ mean and how do you measure it?

Financial health is an individual’s ability to have a day-to-day financial system that helps them be resilient and pursue opportunities. This includes the ability to spend, save, borrow, and plan.

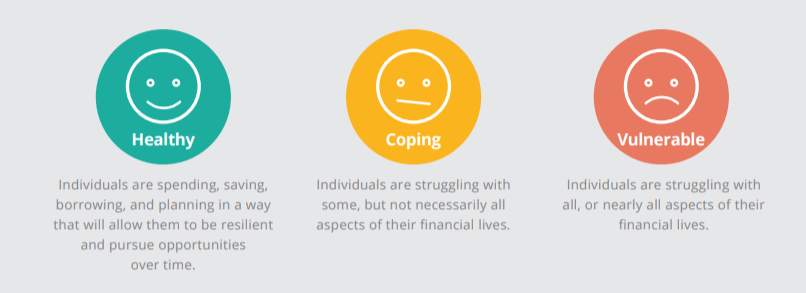

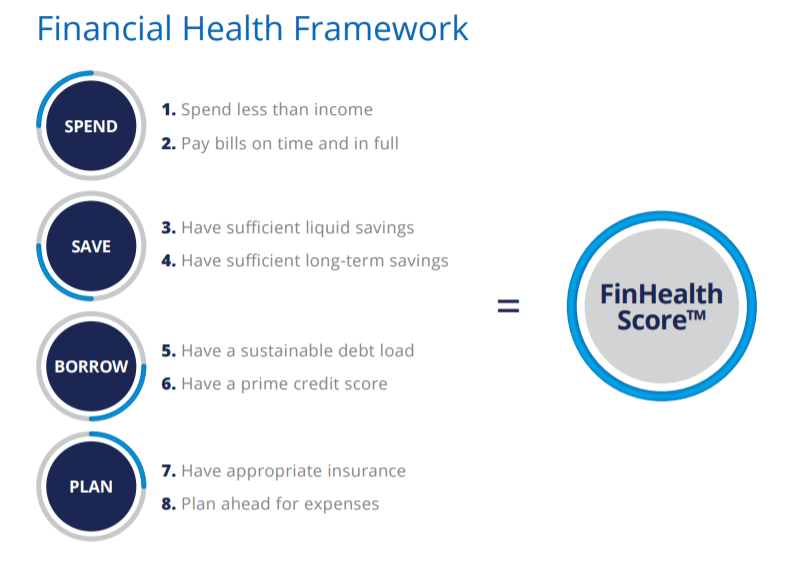

FinFit leverages Financial Health Network’s FinHealth Score™ to diagnose, track, and ultimately improve the financial health of its members. The FinHealth Score™ is based on eight survey questions that align with eight indicators of financial health (see diagram below). For every individual who responds to all eight questions, one aggregate score is calculated and individuals are grouped into three main categories:

From June 2018 – June 2019, FinFit collected and analyzed the responses from its financial health assessments to understand how their members are spending, saving, borrowing and planning, what their financial goals are and how they are feeling about the state of their finances overall. This data includes responses from 30,000+ FinFit members and represents a wide range of people across the United States: industries range from Manufacturing, Health Care, Education, Finance and Insurance, Real Estate, Transportation; ages range from 18 – 65+; annual incomes range from $10,000 – $300,000+.

Three Headline Numbers

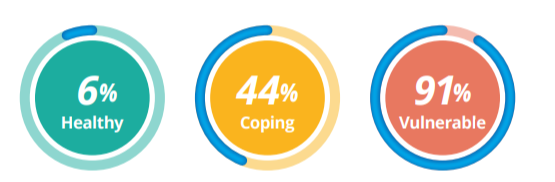

Based on FinFit’s analysis and utilizing the Financial Health Network’s survey methodology highlighted above:

28% of FinFit users are Healthy

(Nationally: 28% or 70 million people)

62% of FinFit users are Coping

(Nationally: 55% or 138 million people)

10% of FinFit users are Vulnerable

(Nationally: 17% or 42 million people)

National comparisons were taken from the “U.S. Financial Health Pulse,” a nationally representative survey conducted by the Financial Health Network that provides an ongoing snapshot of how Americans are managing their finances. The following section breaks down these headline numbers, providing data spotlights that illustrate how FinFit users are managing their money day-to-day and planning for the future, and how this differs depending on what financial health category they’re in (healthy, coping or vulnerable).

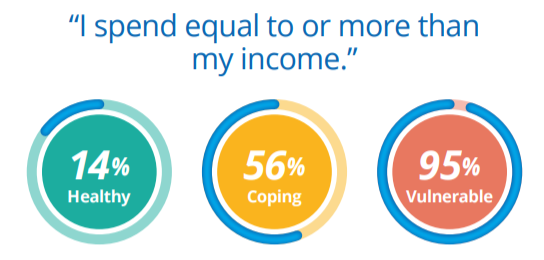

One of the questions FinFit asks its members is if, over the last 12 months, their spending was more, less or about equal to their income. This provides a base level understanding for how individuals are managing their finances and what their cash flow looks like.

48% of FinFit members reported that they spend equal to or more than their income. This is on par with the national comparison – 47% of all Americans.

Why This Matters

When spending exceeds income, Americans overwhelmingly turn to credit to make ends meet. From the U.S. Financial Health Pulse2, we know that among respondents who said their spending exceeded their income in the last 12 months, 43% said they used credit to make ends meet and 10% said they drew upon non-retirement savings.

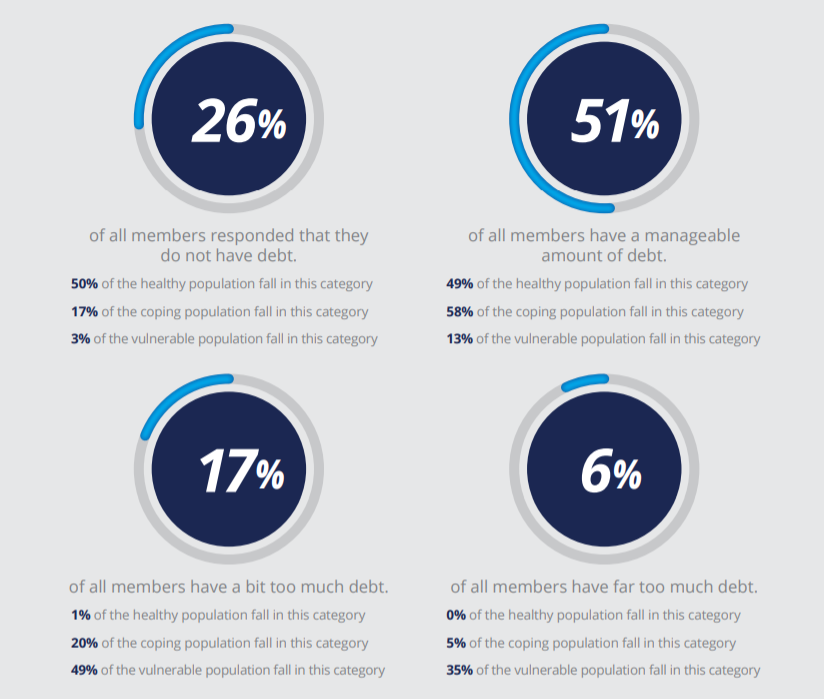

The relationship between spending more than income and relying on debt to make up the difference maps with what we found in FinFit’s assessment results. When members were asked about their monthly debt load:

It is clear from analyzing FinFit data that those who are coping and vulnerable are spending more than their income and are relying on debt to manage their finances (especially compared to those who are healthy). This reliance on debt can often lead individuals to fall into debt traps, which makes it difficult to regain balance and control of one’s finances. Additionally, it is the main reason individuals give in the U.S. Financial Health Pulse research for why they are unable to save for retirement. Therefore, the link between unhealthy spending behaviors and unmanageable debt loads is highly correlated and can often prevent people from planning – and saving – for the future.

Additional findings from FinFit’s assessment results demonstrate the issue is largely behavioral, not solely a matter of resources:

31% of the vulnerable participants make over $50,000 per year

27% of the vulnerable participants are over the age of 45

88% of the vulnerable participants recognize they have too much debt

38% of the vulnerable participants believe their most important financial goal in the next 12 months is to take a vacation

While spending, borrowing, and planning are three of the four pillars FinFit uses to assess a person’s financial health, the final pillar – saving – is the one most people struggle with day-to-day. Therefore, the second data spotlight focuses on short-term savings habits.

“My savings could not cover 3 months living expenses if I lost my main source of income.”

40% of FinFit members reported that they have less than 3 months saved, compared to the national average of 45%.

Why This Matters

The importance of short-term savings on an individual’s overall financial health cannot be overstated. It is often the unplanned medical bill, car breakdown, or urgent roof repair that drives the decision to take out a high-interest loan, turn to a payday lender, take money from long-term savings accounts (college or retirement) or fall further into credit card debt.

In addition, we know from the U.S. Financial Health Pulse that low savings balances obscure the fact that many Americans are saving when they can:

Based on the FinFit assessment results, an overwhelming majority of members identified the following as their top financial goals over the next 12 months:

28% want to set up an emergency fund

26% want to pay down credit card debt

20% want to save for a down payment

16% want to pay down short-term debt

13% want to set up an investment account

12% want to pay down student debt

There is a clear need for additional support to help those who are saving where possible but desire to increase their savings and pay down debt. There is an even greater opportunity to educate and assist those individuals who are not currently saving, helping them to build an emergency financial cushion.

The final section of this report illustrates, via three detailed case studies, how FinFit uses the assessment data to provide personalized roadmaps and recommendations to members based on their unique financial needs and goals.

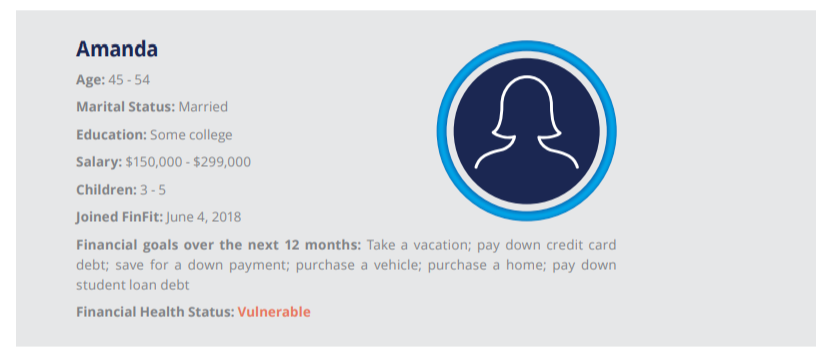

When Amanda joined FinFit, her assessment indicated that she was spending far more than her income, paid very few bills on time, and she only planned ahead occasionally. She had an uncomfortable amount of credit card debt and after helping her children fund their educations, she had just under $200,000 in outstanding student loan debt. From the outside, it may appear as though Amanda’s salary should be sufficient to enable her to pay off debt and save for a down payment on a home. Just because an individual has a healthy income, it doesn’t mean their financial health follows suit.

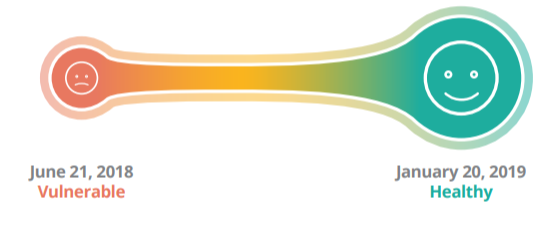

On June 4, 2018, Amanda came to FinFit in a vulnerable state of financial health. But she took the first step – she asked for help. She identified her personal financial goals of paying down credit card debt, paying down student loan debt and purchasing a home. FinFit presented Amanda with her personalized roadmap with recommendations and resources to help her manage her current financial challenges, as well as a plan to set her up for future success.

Amanda utilized FinFit’s financial solutions over the next few months to get back on track, including the student loan services. She took advantage of the many financial education courses in Ready University, specifically focusing on purchasing a home. She completed 13 courses including ‘Is It Better to Rent or Buy?,’ ‘Financing Basics For First-Time Homebuyers,’ ‘How to Finance Your New Home,’ ‘What To Expect At A Mortgage Closing,’ and ‘Compare Mortgage Rates.’ With a home purchase in sight, she used FinFit’s budget calculators to gain insight into what she could afford. She utilized the ‘Mortgage Calculator’ and ‘Closing Cost Calculator’ so she would be empowered to make an informed financial decision on this important investment.

Amanda retook the FinFit assessment on January 4, 2019, six months after joining FinFit. She reported that she now pays all her bills on time and has a manageable amount of debt. She is spending much less than her income and now owns her first home. She reported that she is very confident in her ability to plan, and she always plans ahead to cover upcoming expenses.

Jake joined FinFit on June 21, 2018. His assessment indicated that he had a small amount of debt and was spending a little more than his income. He was not very confident in his ability to plan and he was not able to pay his bills on time. His credit score was poor. He also reported that he had more than 6 months saved in case of emergency, with $50,000-$74,999 in total savings and retirement. Based on his financial assessment, Jake could benefit from creating and sticking to a budget. He needs help identifying ways to be smarter about how he is spending and investing his money based on his current financial situation and life stage.

On June 21, 2018, Jake came to FinFit in a vulnerable state of financial health. He was not aware that with some education and guidance, he had the opportunity to change course and create a plan to achieve his goals. Jake was starting early, recognizing that he did not want to continue down the same path. Through the financial assessment, Jake identified 12-month goals of paying down short-term debt and affording home repairs. FinFit presented Jake with his personalized roadmap, focused on budgeting and money management.

Jake took advantage of FinFit’s MoneyView Dashboard where he was able to link his accounts and track exactly where his money was going. He could easily see where he was overspending, and where he had the opportunity to redirect his cashflow. He used FinFit’s financial solutions to help as he figured out how to better manage his money. He used MoneyView to create a budget, set bill pay alerts and monitor his daily progress. He retook the FinFit assessment on September 22, 2018, and his financial health status had improved to coping.

Encouraged to see he was making progress, Jake used FinFit’s budget calculators to assess his retirement contributions and identify how he could better appropriate his money to achieve his long-term goals. He took a few courses in Ready University like ‘Debit vs. Credit,’ ‘Checking Account Basics,’ and ‘Investment Options.’ He was able to adjust his MoneyView budget as he gained insight into his spending and saving habits.

Jake took the FinFit assessment for the third time on January 20, 2019, six months after joining FinFit. He reported that he spends much less than his income and is paying all his bills on time. He reported that his credit score has improved to ‘fair’ and he is moderately confident in his ability to plan.

When Monica joined FinFit, her assessment indicated that she was not at all confident that she would have enough money to support her long-term financial goals. She had less than $10,000 saved for retirement. She did not plan ahead, and she was only slightly confident about her ability to save. She reported that she spends much less than her income and pays all her bills on time.

On October 2, 2018, Monica came to FinFit in a vulnerable state of financial health. The personal financial goals she identified revolved around creating savings accounts, both short-term and long-term, paying down credit card debt, and saving money. FinFit presented Monica with her personalized roadmap, focused on recommendations and solutions that would help her create savings and plan for her future.

Monica took full advantage of the Ready University educational courses. She built her knowledge around topics like ‘Why you should consider working in retirement,’ ‘13 factors when choosing a place to retire,’ ‘Visualize the retirement you desire,’ and ‘How do you want to spend your retirement years?’ She used FinFit’s MoneyView Dashboard to keep track of her investments and see all her accounts in one place. By linking her accounts, she can track her net worth and follow her month-to-month progress to make sure she is moving in the right direction.

Monica also participates in FinFit IQ, the weekly live trivia game available to all FinFit members. She plays consistently and generally answers most of the questions correctly – she averages 8-10 correct answers, and she recently won a game in May with 12 correct answers. Monica continues to improve her knowledge through Ready University courses, and she’s testing her progress in the weekly trivia games.

Monica retook the FinFit assessment on May 14, 2019, seven months after joining FinFit. She reported that she now feels very confident in her ability to save and she is very confident that she is on track to have enough money to achieve her long-term financial goals. She now contributes 4%-6.9% into her retirement account on a monthly basis, and she is putting 2% of her monthly income into an emergency fund.

Conclusion

The first step to improving an individual’s financial health is to accurately identify and assess their financial situation. It is critical to pair this analysis with tailored solutions and actionable steps to guide the individual down the path towards financial stability and motivate them to change their behavior.