Employee Retention and Productivity Experts

Providing financial wellness services to over 150,000+ US employers

Working with FinFit was like training with a high performance fitness coach… Instead of building muscles and dropping weight, they helped me measure and drive retention results every day – saving us millions.

HR Retention Manager

Real Results from FinFit Clients

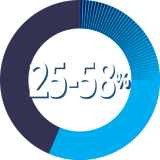

Improvement in Employee Retention

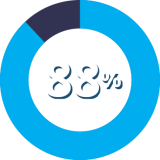

Increase in Employee Productivity

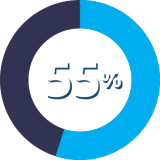

Reduction in 401(k) Borrowing

Significant bottom‑line cost savings for your organization

My workday is packed, yet FinFit was plug-and-play easy. That meant we could get a Financial Wellness benefit up and running quickly without additional time required on our end. Greater retention has also led to less onboarding, which is a huge time-saver, as well.

HR Benefits Administrator

Employees enjoy less stress & increased financial health.

|

|

|

Happier, healthier and more productive employees

In 2020, the pandemic hit and dollars were tight. The CEO tasked me with both launching a financial wellness benefit AND demonstrating an ROI within six months. FinFit’s client success team ensured I had all the data and performance results to achieve the CEO’s directive.

Vice President of Human Resources

Learn how we will build ROI for your organization

Receive a customized benchmarking report and consultation with Jennifer Creech, SVP of Strategic Partnerships, today.