Are Your Employees Leaving You? It’s Not Them. It’s You.

With the unemployment rate at a historically low 3.7%, competition to recruit new talent is fierce. However, one important consideration as you work to fill new positions is the increasing rate of employee turnover. While you are focused on filling new positions at your company, so are other organizations – and they’re busy recruiting the experienced talent working for you!

One way to retain employees is showing commitment toward improving their wellness – particularly, financial wellness. Just how important is a financial wellness program? Based on recent reports on Americans’ finances, it’s critical. A 2017 CareerBuilder survey1 revealed alarming reports on American workers: 71 percent say they are in debt, and 78 percent are living paycheck-to-paycheck. These financial struggles translate to stress, affecting employee health and work performance.

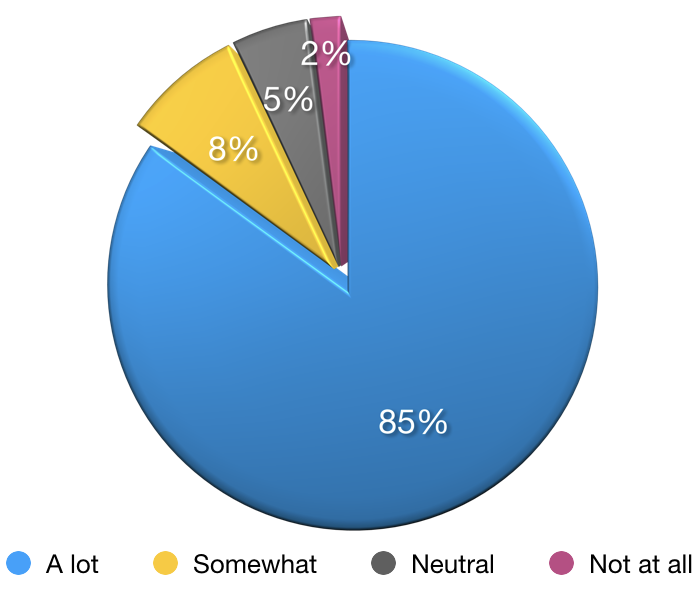

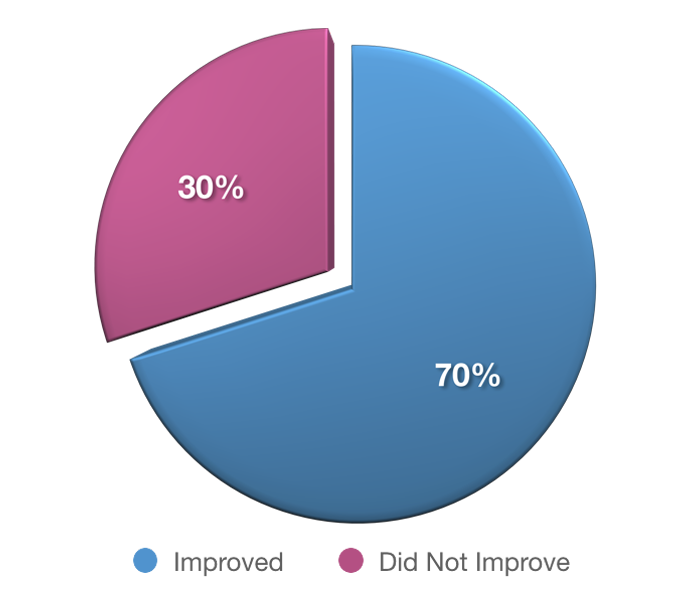

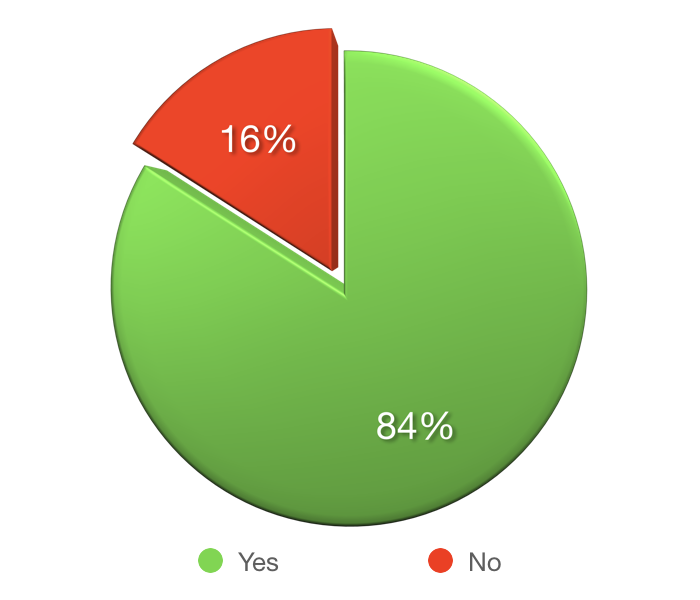

By offering a financial wellness benefit like FinFit, you demonstrate your concern for the wellbeing of your employees. In our 2017 financial survey, 85% of employees said they appreciated their employer for offering FinFit, 70% reported increasing their personal savings through the program and 84% said that FinFit helped them solve a financial crisis and refocus on work.

Appreciate employers more for offering FinFit

FinFit impact on monthly savings

FinFit helped to solve a financial challenge allowing employee to focus on work

One final consideration: benefits are only of benefit if employees perceive them to be so. When you make the extra effort to improve your voluntary benefits offering, make sure (you) and your employees fully understand the features included, why you’re providing it and how it can help them.

If your organization’s employee benefits offering includes financial wellness, now’s a great time to make sure your employees are aware of the features of their benefit. Not yet offering a financial wellness program? Give us a call at 888.928.7248 to learn more, or schedule a short demo of the FinFit platform.