Employee Retention and Productivity Experts

Real Results from FinFit Clients

“I am absolutely blown away by your company’s offerings and user interface; not to mention your team.

We are in the industry of exceptional experiences and first impressions, and your company is delivering +1.”

Allyson, Human Resources

“I thought FinFit was just another sales pitch and sounded too good to be true. Luckily, I was wrong. It’s one of the best benefits out there. This is exciting and makes me feel more hopeful about budgeting my family funds. I think our team will really appreciate this program. Thanks again!”

Amanda, Office Manager

-

“I am absolutely blown away by your company’s offerings and user interface; not to mention your team.

We are in the industry of exceptional experiences and first impressions, and your company is delivering +1.” - “I thought FinFit was just another sales pitch and sounded too good to be true. Luckily, I was wrong. It’s one of the best benefits out there. This is exciting and makes me feel more hopeful about budgeting my family funds. I think our team will really appreciate this program. Thanks again!”

FinFit is offered to millions of employees.

Already a FinFit member? Log in here.

Who is FinFit?

The largest, oldest, most comprehensive financial wellness solution in the United States

Founded in 2008

Dedicated to helping employees and employers improve their financial health and become financially stable.

FinFit at a Glance

What should an effective financial wellness program include?

A holistic financial wellness solution must enable an individual to identify their financial goals, assess the specific areas where financial wellness assistance is needed, and provide tools and resources that allow the individual to achieve financial freedom. FinFit’s financial wellness programs support the key financial elements that impact an individual’s overall well-being: Spend, Save, Borrow and Plan.

The most comprehensive financial wellness program on the market

Financial wellness is a term used to describe the state of one’s personal financial situation. There are many dimensions to financial health and well-being, including the amount of savings you have, how much you’re putting away for retirement and how much of your income you are spending on fixed or non-discretionary expenses.

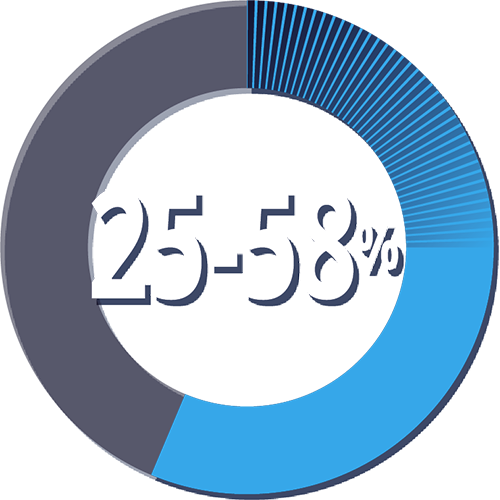

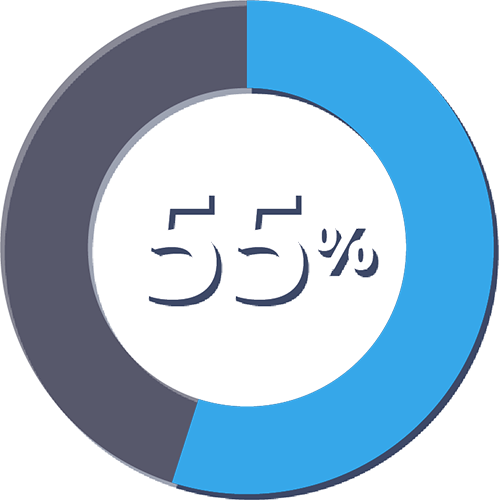

There are many benefits when it comes to financial wellness and wellness programs. To be successful, these programs need to do more than just provide education but need to result in employees’ making positive behavioral changes that lead to financial success. The first step for employees is to identify their current financial health and establish their financial goals through a personal financial assessment.

With relevant recommendations and solutions, they can apply what they’ve learned immediately to create positive behavioral change and establish healthy habits through the use of budgeting tools, financial calculators or a savings program.

Financial counseling from certified professionals can provide the additional encouragement and motivation they need to develop a plan that works for their unique situation. For individuals that need support to overcome current financial challenges, FinFit offers financial solutions that provide an affordable alternative to help them end the cycle of debt and regain their financial health.

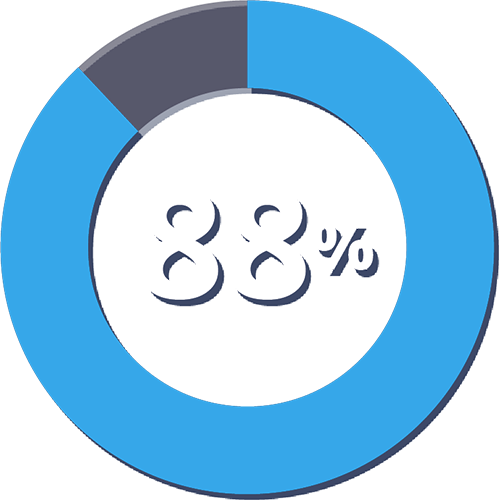

Improving employees’ financial well-being will lead to healthier individuals which in turn, benefits the entire organization by creating a workplace culture of motivated, focused employees. Reduced absenteeism, decreased turnover rates and increased employee satisfaction and morale are a few of the benefits financial wellness programs can bring to an organization.

Delivered via a 24/7 online platform, FinFit delivers financial wellness to employees when and where they need it.

Unlike education-only methods, FinFit provides financial solutions that allow employees to assess their unique financial situation and compare their options.

Employees should be informed and empowered to solve today’s challenges, so they have the opportunity to plan for their future. FinFit is a powerful way for employers to attract and retain talent by helping employees focus, transform their financial situation and become more productive at work.

Discover

Master

Relax

Testimonials

“Our partnership with FinFit is already producing results and empowering our team members to take better control of their financial future. This innovative tool will create opportunities for our team members to set a course for future financial success for themselves and their families.”

“G4S is committed to assessing our benefit offerings on an annual basis to proactively identify gaps and find the best solutions on the market to support our employees. It was important for us as an organization to find the right financial wellness program to help decrease our employees’ stress levels and improve their overall financial wellbeing. FinFit provides a holistic financial wellness offering, and we are excited to support our U.S. employees with this essential benefit.”

“Since implementing FinFit, we have received an extremely positive response from our employees. G4S employees have been asking for assistance with their current financial challenges, as well as educational resources to help them better plan for the future.”

Thom McBride | Director, Employee Benefits | G4S Secure Solutions (USA)