Author: FinFit

VIRGINIA BEACH, Va. –(PRNewswire) — FinFit, a FinTech company that provides over 150,000 employers with a unique financial wellness benefit platform, today announced that its president David Kilby has published a new eBook on hiring, engaging, retaining and understanding the emerging millennial workforce. The eBook is now available at dkilby.com.

Kilby, who is also the author of the book titled The New Productivity Engine: The compelling impact of financial wellness in the workplace,...

To Financial Well-Being and Beyond!

The biggest regret many people have is that they should have saved more and started saving earlier.

In your younger years, it seems you’ll never have enough money coming in to put some into a savings account. The hard truth: that rarely changes. You’ll always find somewhere the money can be spent.

The best way to start saving? Make it a habit. Start early and commit to a lifestyle of saving. If saving becomes part of your behavior, you’ll start there before you begin allocating money towards...

What Does Financial Wellness Look Like FOR YOU?

In our recent blog post, ‘What is Financial Wellness?’ we defined financial wellness as a term used to describe the state of one’s personal financial situation. One of the key phrases in that statement that we didn’t elaborate on is ‘personal financial situation.’

Financial wellness is personal. Financial wellness programs must be unique to each individual, tailored specifically to one’s current financial position. For a financial wellness program to benefit each employee utilizing the products...

Financial Stress Causes Businesses to Lose $450B Every Year

According to the 2019 World Happiness Report, 34% of U.S. employees are without savings. Considering that 78% live paycheck to paycheck, this may not come as a surprise. What is surprising, however, is that one out of four of those without savings earn more than $160,000 per year.

Financial stress is not just a “poor person’s problem.” Not only is it impacting society’s higher earners, but it is also having an impact on the companies where they work. Various reports cite businesses lose between...

Student Loan Repayment – What’s The Best Plan?

When it comes to student loan debt, there are many options available to help you with student loan repayment. It’s imperative that you do your research and understand your options before you make a decision on the best student loan debt management plan.

Federal vs. Private Loans

You’ll first need to know if your student loan is a federal loan or a private loan in order to figure out your repayment options. You can easily determine if you have a federal loan by visiting the National Student Loan...

FinFit Joins the Virgin Pulse Partner Ecosystem to Change Lives and Businesses for Good

VIRGINIA BEACH, Va. –(BUSINESS WIRE) — FinFit, a FinTech company that provides over 150,000 employers with a unique financial wellness benefit platform, today announced a partnership with Virgin Pulse, the leading global health and well-being technology and services company. FinFit is now available to Virgin Pulse clients in the U.S., offering complete access to a suite of essential financial tools and resources to improve employees’ financial well-being.

Virgin Pulse is focused on...

2020 Employee Benefit Trends: Financial Wellness Tops the List

As we enter the fourth and final quarter of 2019, employee benefit trends for 2020 are emerging. Various media outlets and human resource analysts are forecasting the most desirable benefits that employers should add in 2020 if you want to keep your organization on the cutting edge of benefit offerings. It’s important to pay careful attention to these benefit trends if you want to attract and retain the brightest and the best talent. The front-runners for 2020 are pet perks, flexible work schedules,...

Why Should You Offer a Financial Wellness Program?

Implementing a financial wellness program demonstrates that you and your organization care. Financial wellness helps employees recognize that their employers care about them on an individual basis, and this fact alone can provide a more desirable and interactive culture for your organization. 68% of employees feel employers have a responsibility for the health and well-being of their employees. After all, we do spend 30% of our lives working; that equates to 25-30 years! Work is a major contributor...

The Top 5 Benefits of an Employee Financial Wellness Program

When evaluating options for inclusion in your employee benefits package, consider the positive outcomes a financial wellness program can bring to your organization. By giving employees the tools and resources to cope with their current financial situations and make better money decisions related to saving, spending, borrowing, and planning, you’ll see countless positive returns. These are the top 5 benefits your company could benefit from by offering an employee financial wellness plan.

#1: Increased...

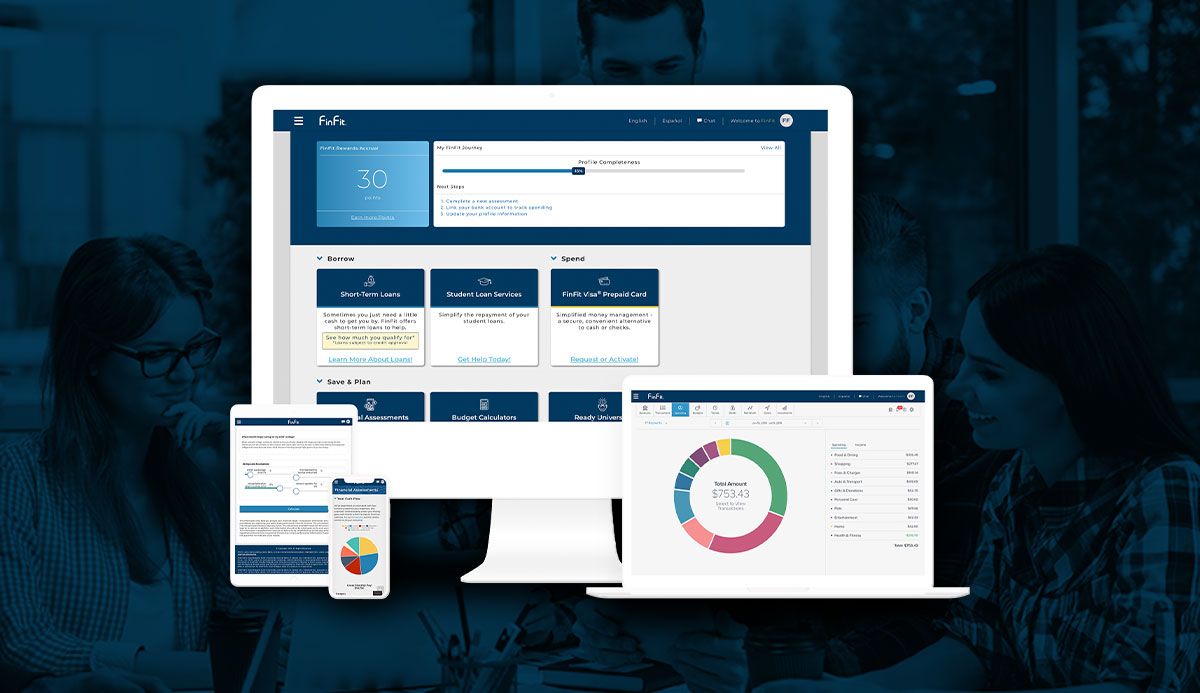

FinFit’s Intelligence-Driven Financial Wellness Platform Motivates Employees

VIRGINIA BEACH, Va.–(BUSINESS WIRE)– FinFit, a FinTech company that provides over 150,000 employers with a unique financial wellness benefit platform, has overhauled the platform to focus on predictive AI, feature enhancements, and ease of use for members.

FinFit announced its mobile-first focus in July, updating FinFit.com with a sleek new look and improved functionality. The user experience for members follows suit, creating a smart, seamless journey site-wide from information-gathering...